Creditas financial results Q3 2021

São Paulo, 8th October 2021

Today, we announce the results corresponding to the 3rd quarter of 2021.

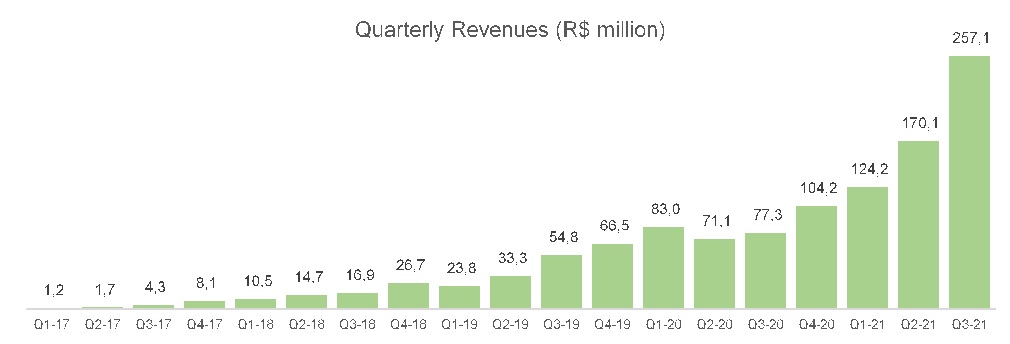

In Q3-21 we posted R$257.1mn in revenues, representing 51% increase compared to Q2-21 and 233% increase compared to Q3-20. Excluding M&A transactions, revenues increased 42% vs. Q2-21 and 213% vs. Q3-20. Our strong momentum is the result of significant technology developments that are allowing us to grow faster as well as a successful implementation of our ecosystem strategy that is increasing customer recurrence in our platform.

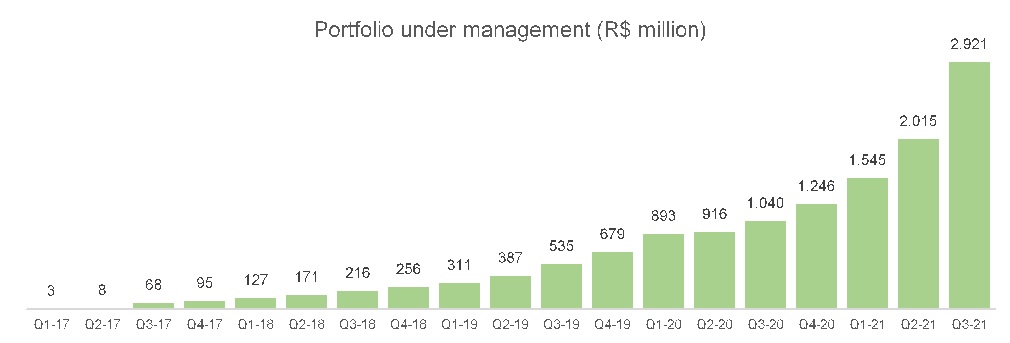

New origination, now including loan origination and insurance premiums, represented R$937.7mn (313% increase vs. Q3-20 and 53% vs. Q2-21), growing our portfolio under management to R$2,920.8 billion. All 3 ecosystems (Auto, Home and Employee Benefits) performed at record levels as we continue delivering high growth and stable margins.

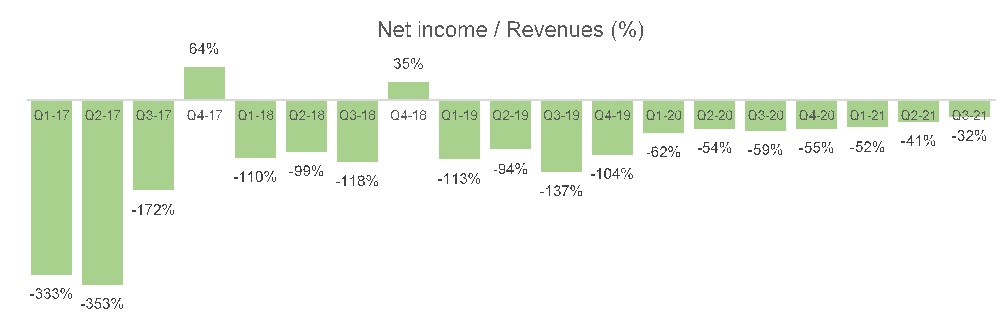

Contribution margin (discounting funding costs, servicing costs, credit provisions and taxes) increased to 55.2% mainly due to strong credit performance and slightly lower portfolio leverage. We posted a net loss of -R$81.2mn in the quarter, representing 32% of revenues compared to 59% in Q3-20, as we continue gaining scale to cover the cost of developing our technology and growing our portfolio.

In Q3-21 we completed five new Debt Capital Markets securitizations for a total of R$1,013mn showing strong investor appetite for our unique asset class. We issued two new FIDCs (FIDC Creditas Auto VI and FIDC Creditas Auto VII) both of which had S&P reaffirmed AAA local rating for the senior quotas and issued our 8th, 9th, and 10th CRI.

This quarter, we consolidated 2 strategic transactions: (i) the acquisition of 100% of Minuto Seguros, the largest digital insurance broker in Brazil (release here), and (ii) the acquisition of 100% of Volanty, a pioneer in the Brazilian used cars market. The consolidation of both entities increased revenues of the quarter by R$15mn (approx. 6% of our total revenues ex-acquisitions).

***

Definitions

Portfolio under management – Includes (i) Outstanding net balance of all our lending products net of write-offs and (ii) outstanding premiums of our insurance business. Our credit portfolio is mostly securitized in ring-fenced vehicles and funded by both institutional and retail investors. Our insurance portfolio is underwritten by 14 insurance carriers.

New Origination – Includes (i) volume of new loans granted and (ii) insurance premiums issued in the period. If new loans refinance outstanding loans at Creditas, new loan origination includes only the net increase in the customer loan.

Revenues - Income received from our operating activities including (i) recurrent interest from the credit portfolio, (ii) recurrent servicing fees from the credit portfolio related to our collection activities, (iii) up-front fees charged to our customers at the time of origination, (iv) up-front revenues recognized at the time of the securitization of the loans, (v) take rate of the insurance premiums issued, (vi) margin of cars sold (metal margin plus service fees minus reconditioning costs) and (vii) other revenues from both lending and non-lending products.

Contribution Margin - Margin calculation deducts from our revenues (i) costs of servicing our portfolio including headcount, data consumption and third-party costs, (ii) costs incurred in our non-lending businesses necessary to generate revenues, (iii) funding costs of our portfolio comprising interests paid to investors and costs related to the issuance of our securitization (e.g. auditors, rating agencies, advisors), (iv) credit provisions related to our credit portfolio and (v) sales taxes related to fees, interest and other revenues.

Net Income - Net income deducts from our Contribution Margin (i) headcount not included in the portfolio servicing cost, (ii) general overhead cost, (iii) customer acquisition cost and (iv) other income and expenses.

Subscribe for

updates

Receive all our news in your email